When we think about how to train our children in handling money, the first thing that generally comes to mind is using an allowance. The topic of allowance and whether or how to use one merits its own conversation (“Making Allowance for an Allowance“). Here, we propose five additional or alternative tools parents can use to build their children’s financial literacy.

We all hear snippets about the bleak financial health of our generation. Right in my email inbox this morning was an article with a headline declaring that millennials are doing worse financially than previous generations, despite their optimistic belief that they are going to be rich at relatively young ages. Quite the opposite it would seem! Millennials are apparently failing to generate enough wealth to retire comfortably, according to a recent study by Brookings. Their poor financial health is attributed at least in part to not saving enough, not having pensions through employment, and falling prey to massive student debt. This picture piggy-backs on the broader idea of a rising generation that is in many ways failing to launch: youth are reaching adulthood without the skills and maturity to independently support themselves.

Launching our children into their adult years equipped with the confidence and know-how to build a solid financial foundation needs to be one of our primary tasks as parents. Despite our best intentions, many of us find ourselves overwhelmed with all the competing demands for our time and attention and doing endless battle with a culture that lures our kids with unrealistic expectations and false [if shiny] promises of instant gratification. How can we battle back? How can we begin to lay a more realistic financial footing for our children?

Here are five ideas to consider:

1. Elicit Money Mentors

As parents, we are finite in our wisdom, experience, and skills. We might also be at the disadvantage of being the voice our kids listen to day-in, day-out, and at times, tune-out. But we do not have to face the task of teaching our children financial skills alone! “It takes a village to raise a child,” so use your village!

Use your village!

Who else in your child’s life has a unique skill or experience with money that is different than your own? What aunt, uncle, colleague, or friend could command your child’s attention and respect, and impart some aspect of financial wisdom to your child? Reach out to these people and ask them to become a money mentor to your family.

Mentors don’t have to carry the weight of teaching everything; invite them to share whatever unique nuggets they are inspired to share, perhaps over a periodic lunch date or other outings. Or invite them to bring your child to their business, or a transaction such as the purchasing of a car. Joline Godfrey, in her book Raising Financially Fit Kids, suggests elevating the dignity of the task by calling it a mentorship and thinking of creative ways to honor it as such. She also offers the important reminder to be sure to recognize and thank these mentors for their time and commitment.

2. Create Family Financial Apprenticeships

One obvious way we can teach our kids about all the aspects of family finances is to include them in the real process of managing it. As with money mentorships, consider formalizing this process into family financial apprenticeships, where each child intentionally participates alongside you in family financial activities of one or more types at an assigned age for a certain period of time.

Turn your kids into financial apprentices and teach them to balance the family budget.

Activities that children can observe and learn to assist in include setting or evaluating the family budget, tracking expenses, planning for a large expense such as a car or vacation, paying bills, making charitable contributions, and filing taxes. Get creative, and consider all aspects of family finances to be fair game for apprenticeship.

Some families might decide to have children apprentice in alternating or increasingly complicated tasks over a period of years, whereas other families might decide that each child participates in a more all-encompassing apprenticeship during one of their final years at home.

3. Assign Areas of Full Responsibility

While the idea of an apprenticeship is for each child to observe and learn through the process of participating in the family’s finances, another valuable way of building financial responsibility is by assigning your child 100% responsibility over a particular budget category for their own personal needs. For example, consider having your

middle-schoolers be responsible for purchasing all of their own clothes. Define your expectations and the full parameters of their responsibility, and finance the category at a level that makes sense for your family and meets their basic needs, but not necessarily at a level that accommodates the higher prices of brands they would prefer or items beyond their immediate needs.

4. Identify and Articulate Family Values

Knowing our personal and family values creates an incredibly powerful, grounded center from which we can evaluate options in our lives and make the best possible choices that are in line with what is most important to us, including how we approach finances. It also creates a language that communicates evaluation and decision-making processes between individuals in a family.

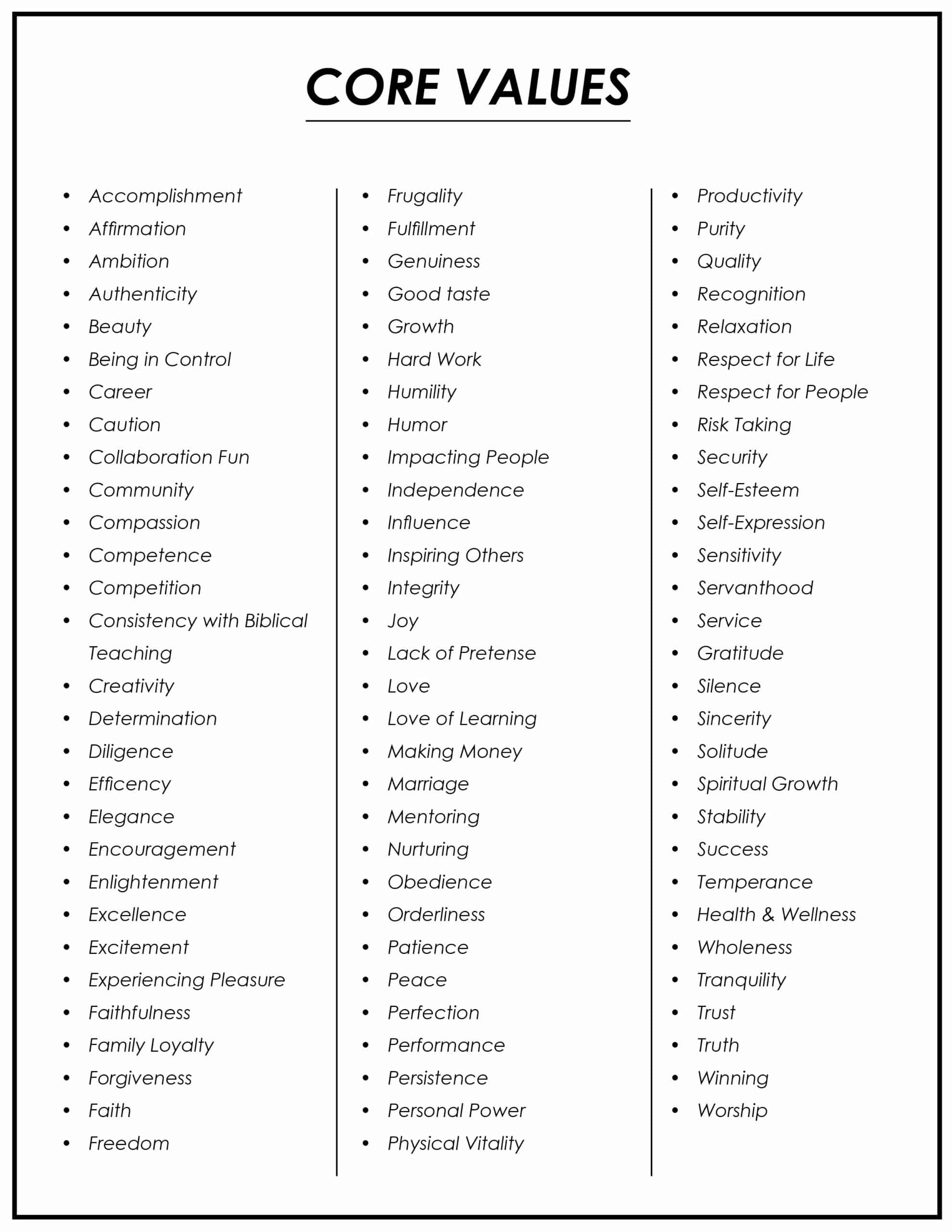

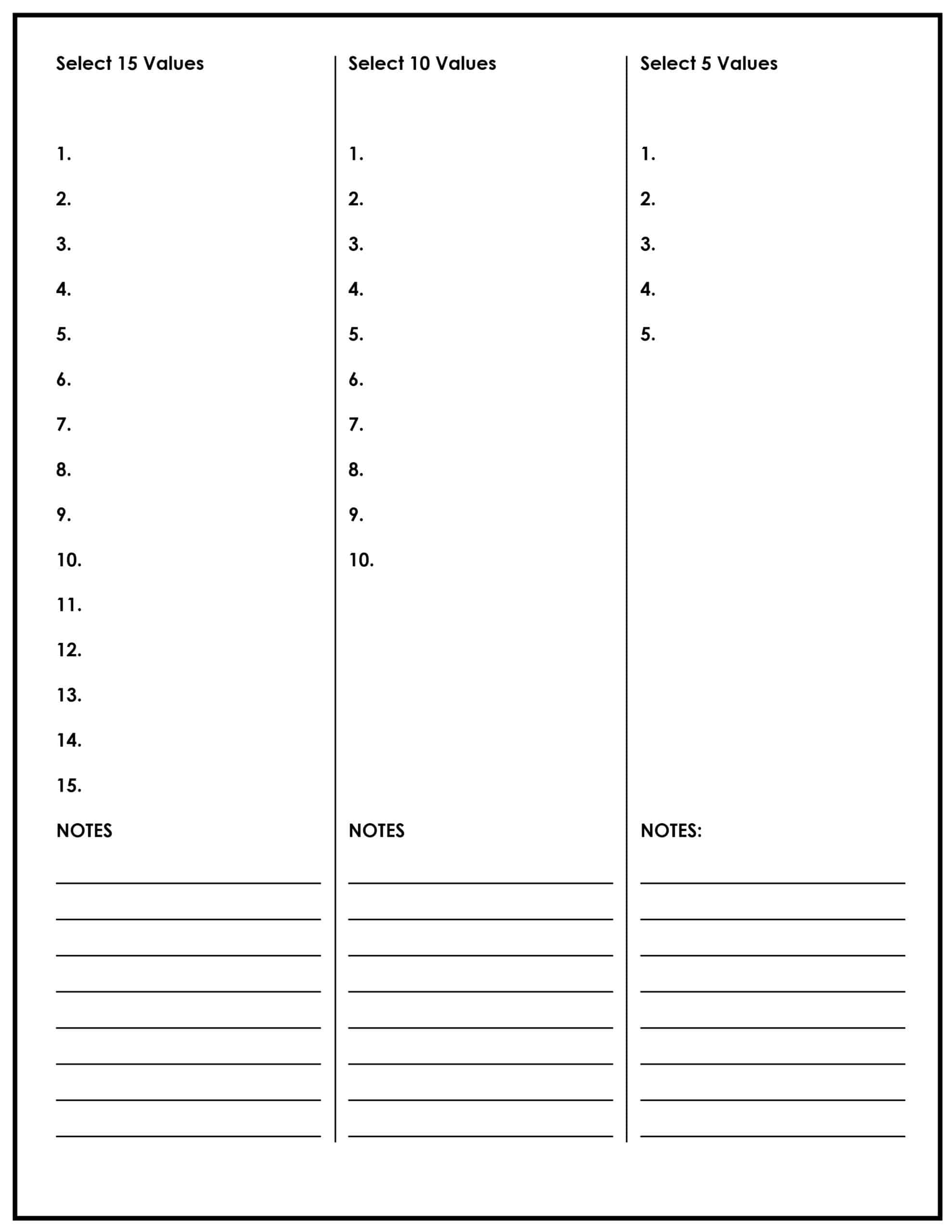

Identifying values can be as simple as googling “personal values list,” like this one from Christian Coach Institute, printing that list out, and then highlighting the values that stand out to you. In a first run over the list, highlight 10-12 of your most important values. Take a second run over the list, and see if you can narrow it down to your top five. Have each individual in the family make his or her own list, and then take time as a family to create a family values list. Don’t worry about which values are money-related or not; in truth, all values ultimately guide all decisions in our lives, including those that relate to our financial situation.

Used with permission from Christian Coach Institue https://www.christiancoachinstitute.com/core-values-clear-core-values/

Once you have a family value list, build it into your family vocabulary. Practice talking about decisions from a values context. For example: “Based on our family’s value of generosity, we are going to donate some of our eating-out budget this month to the local food pantry in time for Thanksgiving … let’s brainstorm some fun ideas for a night in!” or “Our family values gratitude, so let’s take some time to think of all the ways God has provided this week and thank Him for it!” or “Our family values adventure, and we’d love to make a family vacation happen. What can we cut back on to work this into the budget?”

Once you have a family value list, build it into your family vocabulary.

It is also worth taking time to discuss and understand each family member’s personal values, and how that might mean different individuals will approach situations differently. Learn to respect and honor each other’s values, while also learning to problem-solve, cooperate, and reach family decisions as a team that has the same goal.

5. Get Your Own Ducks in a Row!

This idea might very well have been the first one mentioned! As powerful as all these other specific tools can be, we must realize that our actions speak much louder than our words, and that our children are observing us more than we generally give them credit for.

If we tell our kids to be frugal and not get caught up in the latest brands and fads, but we over-reach our own budget to buy a hot-label winter coat for ourselves, or a car that has more options than we really need, how can we not expect our message to land on deaf ears? Or how can we expect to teach our kids to give sacrificially and joyfully, when our own giving is an after-thought of scraps?

The good news is you don’t need to wait until you have every money skill perfected before assisting your children in building their own. Let your parental love and responsibility be a motivation to learn and grow right alongside your kids. What better incentive to get your own budget in order is there than knowing that your teenager is going to be apprenticing alongside you in managing it?

Maybe it is time to reach out to find your own money mentor! Be honest with your older children about your mistakes and your own need for growth; it teaches our kids the equally valuable lesson that we are all lifelong learners, and that being honest and reaching out for help is a much more effective response than covering mistakes or giving up.

{{cta(‘5831ec06-0d1e-490b-8909-252b3a662861′,’justifycenter’)}}

{{cta(‘061dcdb5-e394-45c1-82db-c5b8df62df31′,’justifycenter’)}}